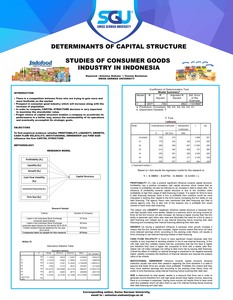

Siahaan, Antonius TP. DETERMINANTS OF CAPITAL STRUCTURE STUDIES OF CONSUMER GOODS INDUSTRY IN INDONESIA Raymond, Antonius TP. Siahaan, Yosman Bustaman Swiss German University antonius.siahaan@sgu.ac.id,. In: Konferensi Ilmiah Akuntansi VI, 14 - 15 Maret 2019, Trisakti School of Management.

|

Text

PROSIDING KIA VI.pdf Download (3MB) | Preview |

|

|

Text

Sertifikat_Konferensi Ilmiah Akuntansi VI.pdf Download (565kB) | Preview |

|

![[img]](http://repository.sgu.ac.id/2498/3.hassmallThumbnailVersion/Poster%20KIA.jpg)

|

Image

Poster KIA.jpg Download (3MB) | Preview |

|

|

Text

Korespondensi Poster Diterima KIA VI.pdf Download (428kB) | Preview |

|

|

Text

PROSIDING KIA VI-190.pdf Download (143kB) | Preview |

|

|

Text

AS_Konferensi Ilmiah Akuntansi IV-Trisakti_Mar19.pdf Download (630kB) | Preview |

Abstract

This research is conducted to provide evidence on the impact of profitability, liquidity, growth, cash flow volatility, institutional ownership, and firm size on a firm capital structure. The object researched is consumer goods firms in Indonesia that is listed in the Indonesian Stock Exchange. Based on the findings of the panel data analysis during the period 2014-2016, profitability exhibits statistically positive significant relationship with capital structure while liquidity, cash flow volatility, and institutional ownership exhibits a statistically negative significant relationship with capital structure, finally size and growth exhibits a negative but insignificant relationship with capital structure. The theories that are used in this research are the pecking order theory, agency cost, and trade-off theory and results of this research also support those theories. Keywords: Capital structure, profitability, liquidity, growth, cash flow volatility, institutional ownership, firm size

| Item Type: | Conference or Workshop Item (Poster) |

|---|---|

| Subjects: | H Social Sciences > HG Finance > HG4001-4285 Finance management. Business finance. |

| Depositing User: | Antonius Siahaan |

| Date Deposited: | 10 Apr 2023 02:31 |

| Last Modified: | 10 Apr 2023 02:31 |

| URI: | http://repository.sgu.ac.id/id/eprint/2498 |

Actions (login required)

|

View Item |